- cross-posted to:

- linux@discuss.tchncs.de

- cross-posted to:

- linux@discuss.tchncs.de

Marcel LUX III SARL (Marcel) as the largest shareholder in SUSE is planning to take the company private and delist it from the Frankfurt Stock Exchange. SUSE will be merged with an unlisted Luxembourg entity. Marcel currently owns a 79% stake in SUSE.

This is the best summary I could come up with:

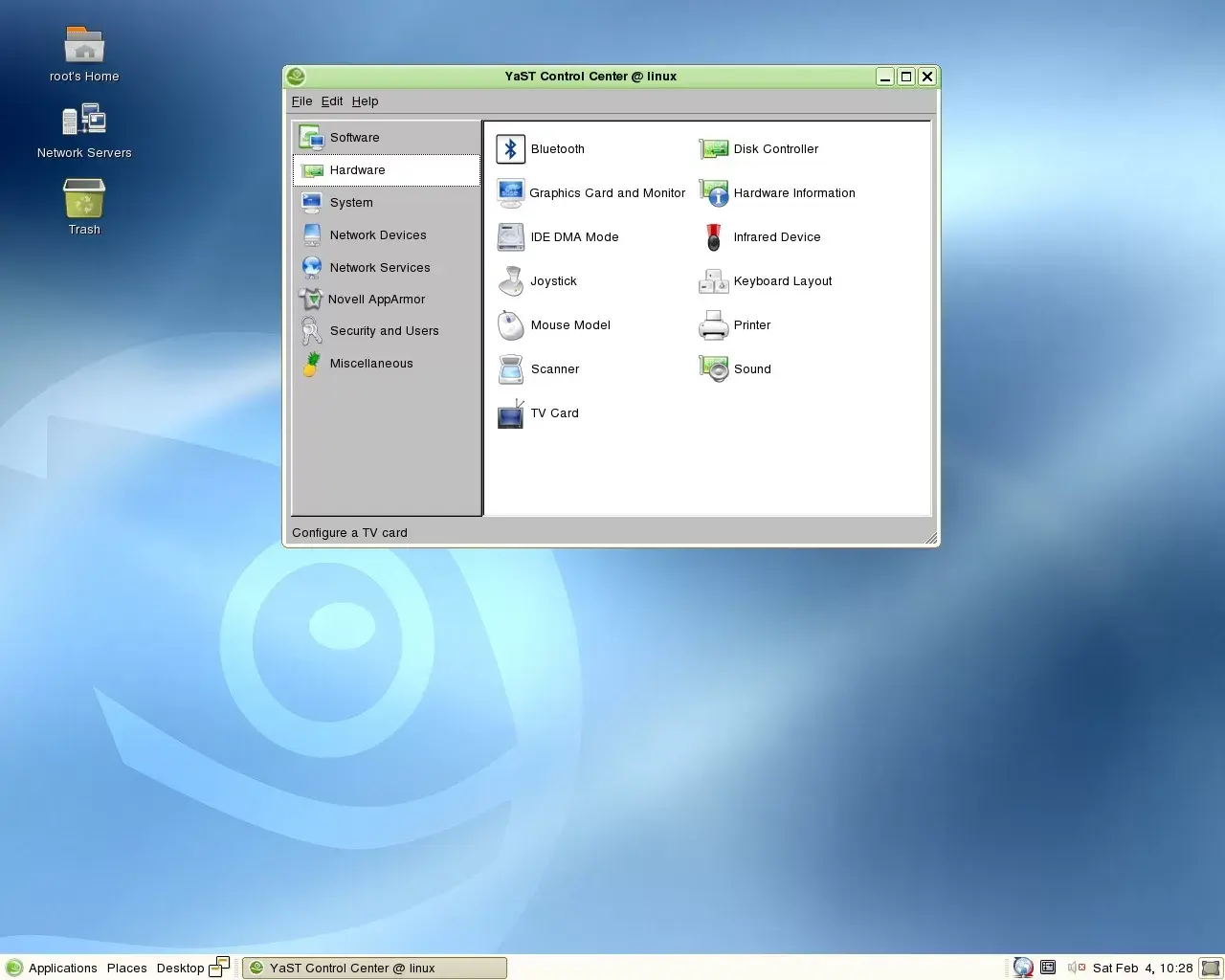

The SUSE organization has changed hands many times over the years… From being its own independent company to the notable acquisition by Novell two decades ago.

Over the past decade SUSE has changed hands between Attachmate, Micro Focus, EQT Partners, and then went public back in 2021 on the Frankfurt Stock Exchange.

Marcel LUX III SARL (Marcel) as the largest shareholder in SUSE is planning to take the company private and delist it from the Frankfurt Stock Exchange.

In taking SUSE private, the EQT Private Equity / Marcel is offering a ~16 EUR per share price, around a 67% premium over today’s share price.

"SUSE’s Management Board and Supervisory Board support the strategic opportunity from delisting of the company as it will allow SUSE to focus fully on its operational priorities and execution of its long-term strategy.

The interim dividend will be paid to all shareholders prior to the settlement of the Offer and will allow Marcel to finance its purchase of SUSE shares under the Offer and certain transaction costs incurred by it."

I’m a bot and I’m open source!

Good bot!

Also, I’d argue this is a good step forward for Suse, as it will take a lot of shareholder pressure off of them.